modified business tax id nevada

TID Taxpayer ID Search. File for Nevada EIN.

If you need help with the Nevada Modified Business Tax Form or the Nevada Modified Business Return AMS Payroll 134 is the best product to try.

. Exceptions to this are employers of exempt organizations and employers with household employees only. Double check all the fillable fields to ensure full accuracy. To avoid duplicate registrations of businesses you are required to update your account with your Nevada Business ID example.

SalesUse Tax Permit Modified Business Tax Department of Taxation Local Business License. Use a check mark to point the answer where needed. Get Your Nevada Tax ID Online.

Registering to file and pay online is simple if you have your current 10 digit taxpayers identification number TID a recent payment amount and general. Nevada Modified Business Tax Rate. This address will be used to mail any licenses reports tax returns and correspondence.

The majority of Nevada businesses will need to get a federal tax ID number. Top Apply For Your Nevada Tax ID Now. Search by Business Name.

To get your Nevada Account Number and MBT Account Number register. If you have Taxation-specific questions or comments please contact the Nevada Department of Taxation for assistance at 866 962-3707. Total gross wages are the total amount of all gross wages and reported tips paid for a calendar quarter.

Register File and Pay Online with Nevada Tax. Applying for a Nevada Tax ID is free and you will receive your permit immediately after filing your application. Click Here for details.

Whether youve formed a corporation created a partnership established a trust or simply opened a new small business you will need a Nevada Tax ID number. Employers may deduct allowable health care expenses from the taxable wage amount. Federal Tax ID EIN Number Obtainment.

Failure to remit Nevada Use Tax Modified Business Tax Tire Fees Live Entertainment Tax Liquor or Tobacco Taxes. Operating without a Sales Tax Permit. This number should be used to address questions regarding sales use tax modified business tax general tax questions or information regarding establishing a new Taxation account.

NV DETR Modified Business Tax Account Number. You must provide a valid Nevada Account Number and Modified Business Tax MBT Account Number to sign up for Square Payroll. An Easy to Use Business Solution.

Modified Business Tax is a self-reporting tax and you are responsible for properly characterizing your business as a Financial Institution or General Business. Use the Sign Tool to create and add your electronic signature to signNow the Nevada modified business tax return form. Search by Permit Number TID Search by Address.

Enter your Nevada Tax Pre-Authorization Code. Failure to collect or remit Sales Tax. Follow these steps to get your Modified Business Tax Return Nevada edited with accuracy and agility.

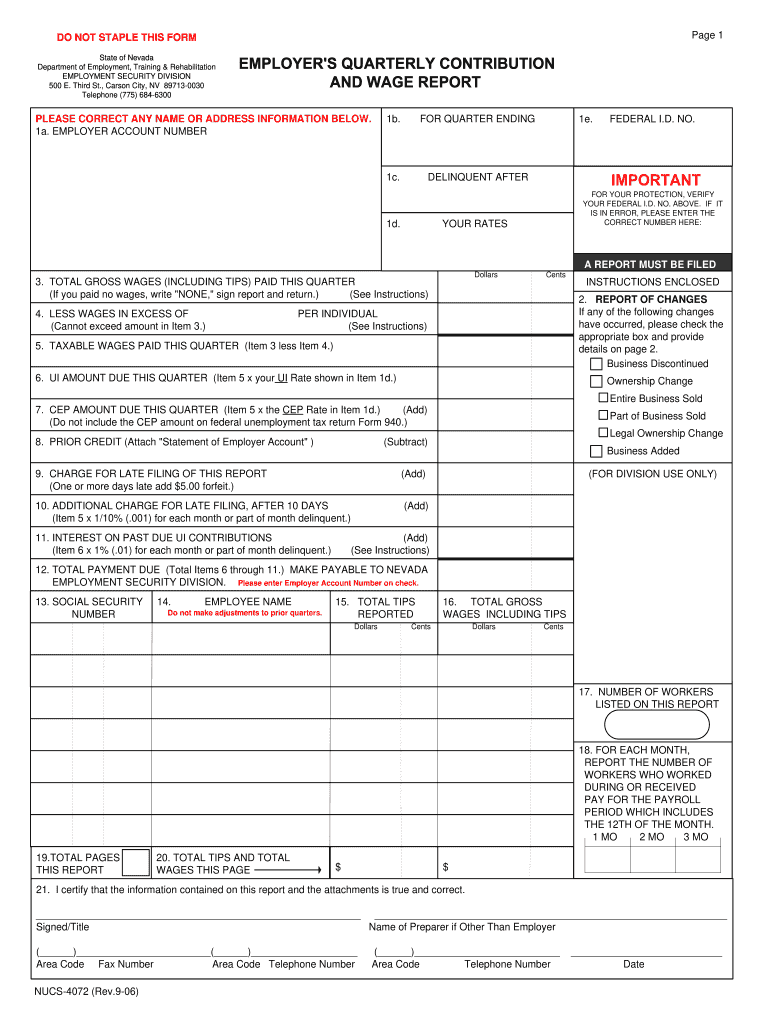

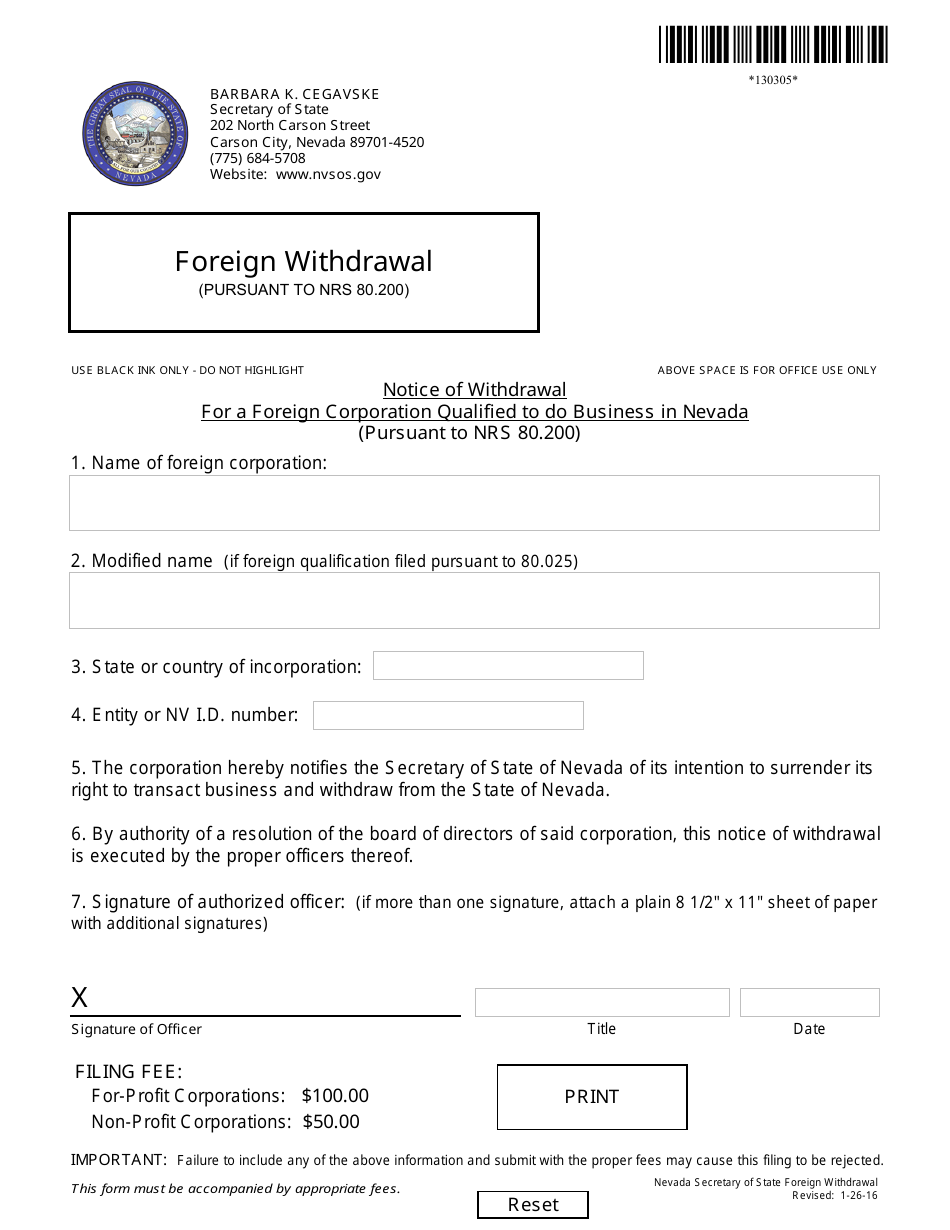

What is the Modified Business Tax. Modified Business Tax Return-Financial Institutions 7-1-19 to Current This is the standard quarterly return for reporting the Modified Business Tax for Financial Institutions as defined by NRS 360A050. You can easily acquire your Nevada Tax ID online using the NevadaTax website.

How to Edit Your Modified Business Tax Return Nevada Online Easily and Quickly. The New Business Checklist can provide you a quick summary of which licenses youll need estimated cost and time to obtain licensing. Tax is based on gross wages paid by the employer during a calendar quarter.

These numbers are required for us to make state tax payments and filings on your behalf. There are no changes to the Commerce Tax credit. NV20151234567 obtained from the Nevada Secretary of State.

If you have an existing business registered with the Department of Taxation you will need to enter your Business Name and 10-digit Tax ID number. Tax Identification Number TID. However the Department will classify taxpayers when it discovers through account review audit a lead or other research that a company falls into one of the definitions under NRS 363A050.

If your business has taxable wages that exceed 62500 in a quarter then the MBT is applied. Nevada Business ID Number. NV Taxation - Permit Search.

Ask the Advisor Workshops. Vehicle RV aircraft or vessel tax evasion. You will be forwarded to our PDF editor.

This bill mandates all business entities to file a Commerce Tax return. The Department is now accepting credit card payments in Nevada Tax OLT. Clark County Tax Rate Increase - Effective January 1 2020.

Enter the number as shown on your State Business License or exemption issued by the Secretary of State. In the New Nevada Employer Welcome package sent by NV after a company registers with the DETR. Messy andor incomplete data is the greatest problem facing most business owners and accountants during this process.

Effective July 1 2019 the tax rate changes to 1853 from 20. GovDocFilings easy to complete application form makes the. The Tax IDentification number TID is the permit number issued by the Department.

Wages are as defined in NRS 612190. Click here to schedule an appointment. General Business General business is considered as any employer who will be required to pay a contribution to the Department of Employee Training and RehabilitationEmployment Security Division pursuant to NRS 612535 in any calendar quarter.

MBT or Modified Business Tax is a type of Nevada commerce tax that is applicable to two types of categories and they are. Try to edit your document like signing highlighting and other tools in the top. However you may owe a modified business tax MBT rate of 117 percent if taxable wages exceed 62500 in a quarter.

Check out articles mentioning Modified Business Tax MBT in Nevada Business Magazine. Our payroll software makes data generation storage and application easy. Enter your official contact and identification details.

The modified business tax covers total gross wages less employee health care benefits paid by the employer. Otherwise no MBT will be due. The modified business tax MBT is considered a payroll tax based on the amount of wages paid out in a quarter.

Nevada modified business tax covers total gross wages amount of all wages plus any tips for each calendar quarter minus employee health care benefits paid by the business. Nevada Business ID NVB ID. If your taxable wages fall under 62500 then you do not pay the MBT.

Dont Have a Nevada Account Number andor an MBT Account Number. 99-9 9 digits Find a current MBT Account Number. Follow the on screen instructions to Verify Your Business using the Nevada Tax Access Code found on the Welcome to.

The current MBT rate is 117 percent. Click the Get Form button on this page. In Nevada there is no state-level corporate income tax.

How To File And Pay Sales Tax In Nevada Taxvalet

Nevada Series Llc Form A Series Llc In Nevada Truic

How To File And Pay Sales Tax In Nevada Taxvalet

Nevada Modified Business Tax Return Fill Online Printable Fillable Blank Pdffiller

How To Form An Llc In Nevada Llc Filing Nv Swyft Filings

James Settelmeyer Settelmeyernv Twitter

Obtain A Tax Id Ein Number And Register Your Business In Nevada Business Help Center

How To File And Pay Sales Tax In Nevada Taxvalet

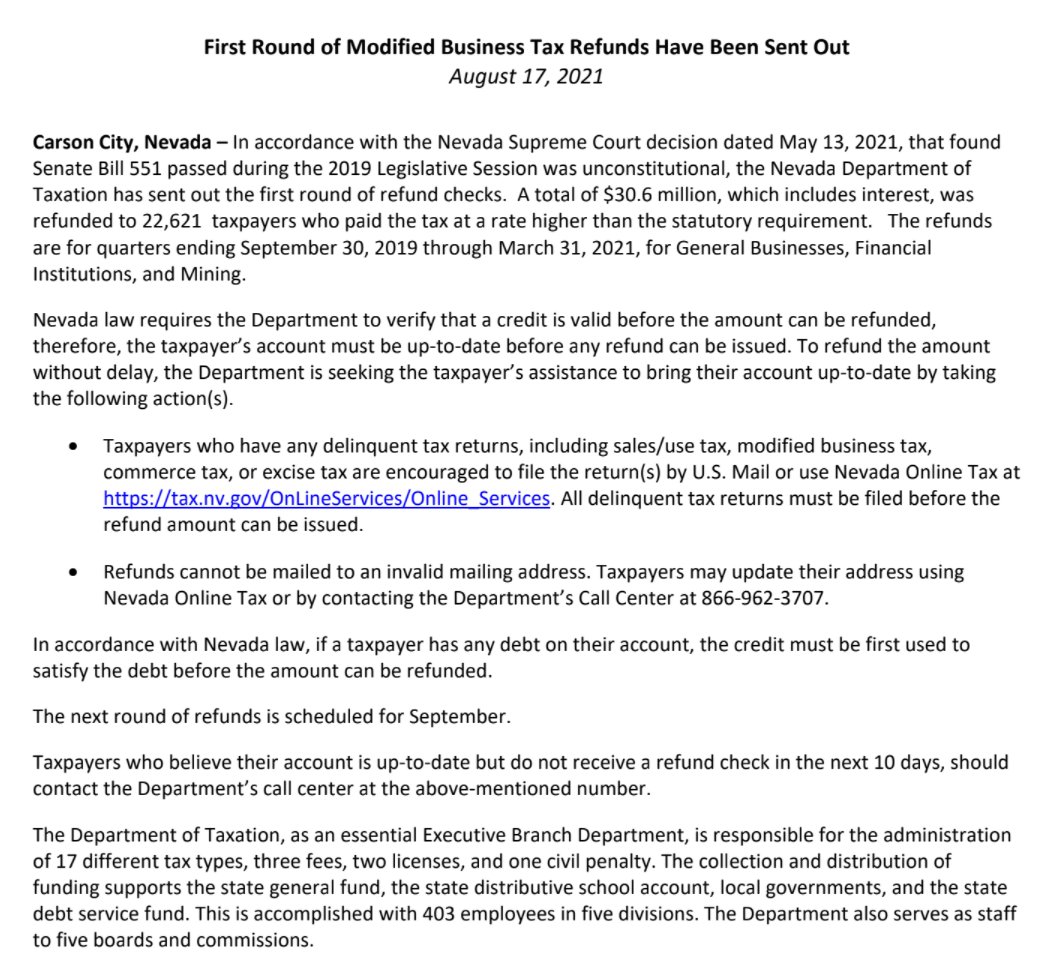

Form Nucs 4072 Fill Online Printable Fillable Blank Pdffiller

Form Txr 021 05 Mbt Fi Download Fillable Pdf Or Fill Online Modified Business Tax Return Financial Institutions 2016 Templateroller

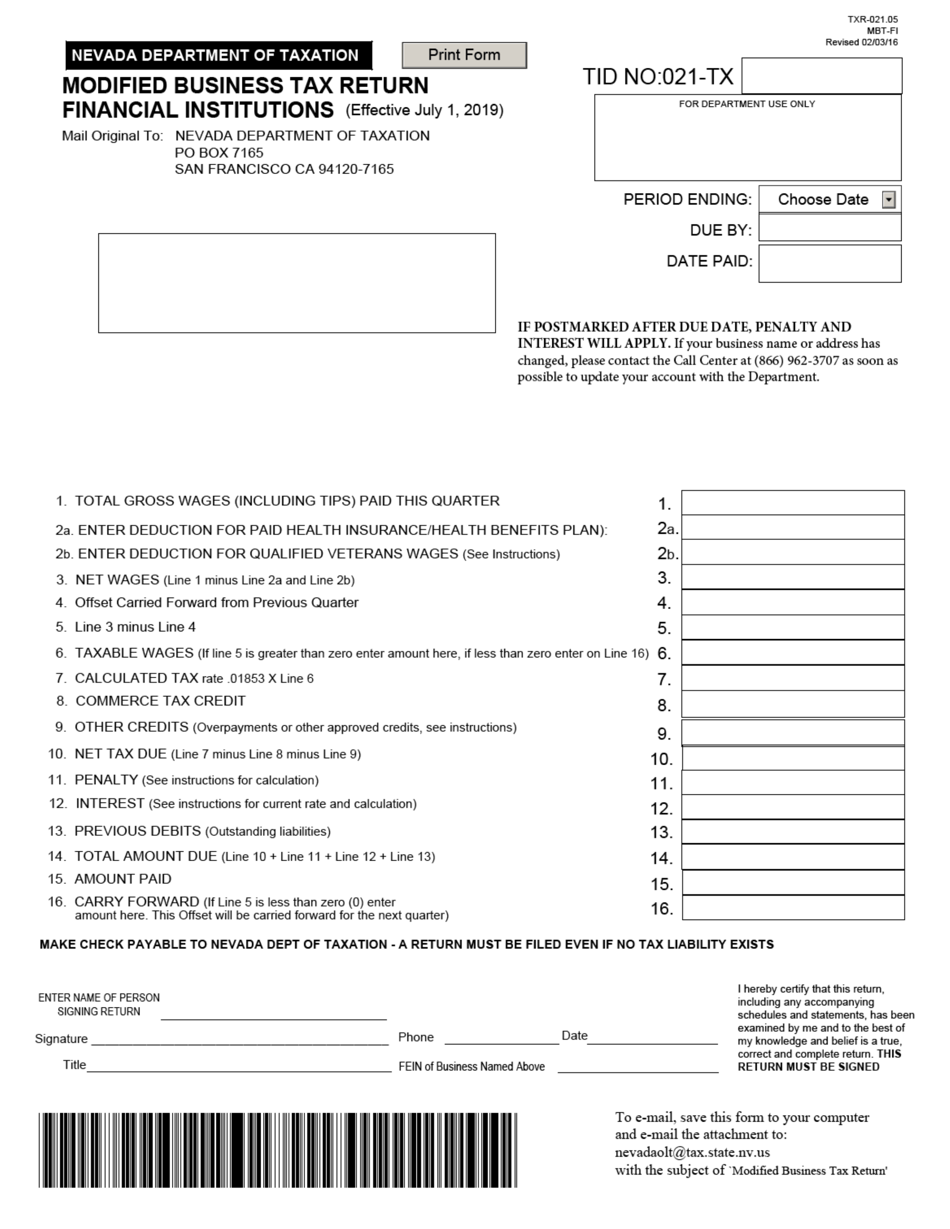

Form 130305 Download Fillable Pdf Or Fill Online Notice Of Withdrawal For A Foreign Corporation Qualified To Do Business In Nevada Pursuant To Nrs 80 200 0 2016 Templateroller